|

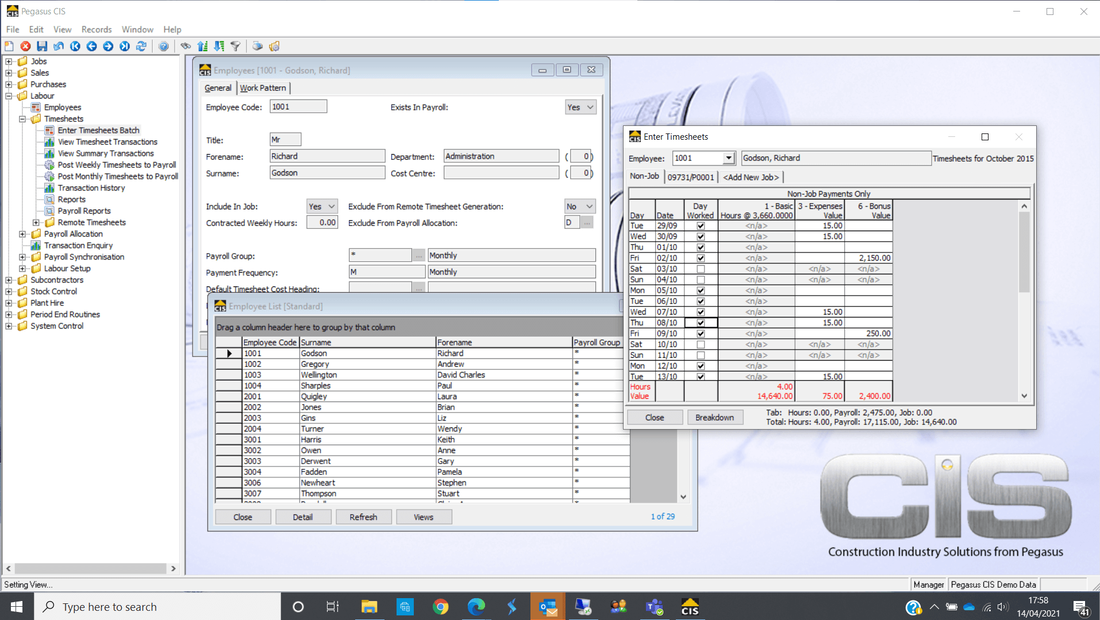

Flexible labour charging to contracts Employees and their pay rates are entered in your Payroll solution and are accessible to Pegasus CIS so that timesheets can be processed. Timesheets are posted to the individual jobs, as well as to the Payroll, so that payslips can be produced. These costs can be posted to the job as a net, gross or charge-out rate, all with an optional overhead recovery percentage. For UK customers that want the 'on costs' from their Payroll, such as Employers' NI and pension, to be apportioned back to the jobs after the Payroll run, it is a simple matter of running the Payroll Import. These costs can be automatically apportioned to the correct jobs based on the values that came from each of the timesheet entries. Pegasus CIS supports Remote timesheets, which can be entered by site managers and transferred to the Payroll department for checking and amending, prior to posting to the jobs and Payroll. The data entry screens are optimised for quick and easy data input, which is easily important for customers with a high volume of transactions. |

Key Features:

- Integration with Opera 3, Sage 50 and Sage 200 Payroll and Nominal Ledgers

- Import of Employees and Pay Elements from Payroll

- Entry of Timesheets with Allocation to Jobs

- Posting Routine to post Timesheets to Payroll (for wage slip production)

- Or Import Timesheets from Payroll and Allocate Cost to Job

- Export / Import of Remote Timesheet Excel Spreadsheets

- Import of "On-Costs" from Payroll and Allocation of Costs across Jobs (e.g. Employers NI, Pensions and Miscellaneous)

- In-depth Cost Analysis and Excel Integration