|

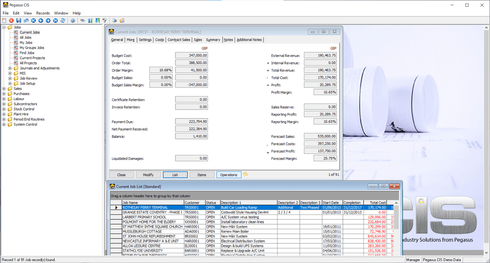

Cost control is critical in any industry and effective cash management can make a serious difference to the profit on a job. Pegasus CIS Job Costing captures all contract information across every stage of a job and makes it immediately available for analysis. Job Heads Each Job can be divided into an unlimited number of Job Heads, each of which can be linked to nominal accounts for automated journals. Each Job Head will hold separate information on budgets, revenue and costs to date, allowing actual to budget variance analysis and reporting. It is possible to set up original analysis and reporting. |

It is also possible to set up original and revised budgets, and split these across periods. Revenue budgets can also be split across periods for cash flow forecasting. All cost transactions are posted to a Job and a Job Head. Job Heads can represent cost categories such as labour or materials, each with an unlimited number of subheads. Alternatively, Job Heads can be linked to Phases to represent job stages. This flexibility allows costs to be tailored in a way that best suits the needs of your business.

Revenue Transactions

A detailed audit file is held for all revenue transactions on a Job, such as from direct invoices generated via the payment application and certification routines. It is also possible to view and reprint any of the historic contract applications. If retention is held against an invoice or a contract it is possible to report on this and apply for the retention to be released on the correct date.

Cost Transactions

A detailed audit file is held for all costs posted to each job. This information can be displayed per Job or per Job Head and can be sorted, filtered and grouped, giving instant-on-screen analysis of all costs; this in turn can be linked to Microsoft Excel for further analysis.

Posting Costs

Costs are posted to a Job as detailed transactions with summary totals maintained at Job, Phase and Job Head Levels. Flexible on-screen enquiries are available for all transactions. Costs can be posted from the following sources:

Key Features

Revenue Transactions

A detailed audit file is held for all revenue transactions on a Job, such as from direct invoices generated via the payment application and certification routines. It is also possible to view and reprint any of the historic contract applications. If retention is held against an invoice or a contract it is possible to report on this and apply for the retention to be released on the correct date.

Cost Transactions

A detailed audit file is held for all costs posted to each job. This information can be displayed per Job or per Job Head and can be sorted, filtered and grouped, giving instant-on-screen analysis of all costs; this in turn can be linked to Microsoft Excel for further analysis.

Posting Costs

Costs are posted to a Job as detailed transactions with summary totals maintained at Job, Phase and Job Head Levels. Flexible on-screen enquiries are available for all transactions. Costs can be posted from the following sources:

- Time Recording

- Payroll

- Subcontractors Ledger

- Purchase Invoice Register

- Plant Hire

- Stock Control

- Internal Cost Allocations, Job Journals, Direct Costs, Petty Cash

Key Features

- Integration with Opera 3 / Sage 50 and Sage 200 Nominal Ledger

- Budgeted Costs and Actual Costs/ Budget Variance Reporting

- Calculated Costs to Complete Multi-level Cost Groups / Cost Heads and Projects

- Cost Type Breakdown into Line Elements

- Flexible Nominal Coding by Cost Head

- On-screen enquiries - Applications, Certifications, Retentions, Balance Outstanding and Costs

- Aged Application Reporting

- Viewing and Posting Journals and Provisional Costs

- Control Work in Progress

- Aged Retention Reporting

- View Transactions on selected Job or across all Jobs In-depth Cost Analysis and Excel Integration